CPI and WPI inflation have started inching up again, as the effect of

a higher base starts to wear off. Higher food prices played a part as

well. The positive IIP number raised bullish hopes.

FIIs have been net sellers of equity worth Rs 2200 Crores this month. DII net buying of about Rs 1400 Crores has prevented a bigger fall in Nifty. Both FIIs and DIIs were net sellers today.

Global economic growth is likely to be lower than an earlier forecast of 3.4% by the World Bank. Sharply falling oil prices is an indication of lack of demand. Slower growth and a rising Dollar index have motivated many FIIs to book profits.

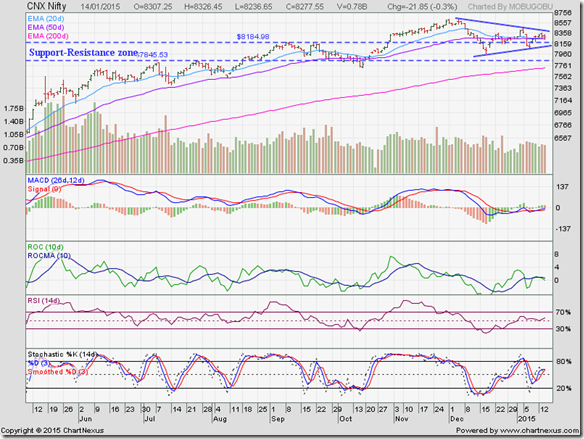

After forming a small ‘double top’ reversal pattern in early Dec ‘14 (by touching levels of 8623 on Dec 1 and 8627 on Dec 4), Nifty corrected sharply below its 20 day and 50 day EMAs but found good support in the support-resistance zone between 7840 and 8180.

The index has since been consolidating sideways within a ‘symmetrical triangle’ pattern. Since triangle patterns tend to be unreliable, the eventual break out can occur in either direction.

The index has already touched the upper (downward-sloping) resistance line and the lower (upward-sloping) support line of the triangle twice. That means a break out from the triangle can occur at any time.

Remember that for technical validity any upward break out should be accompanied by a surge in volumes. Otherwise, the break out may turn out to be ‘false’. A downward break does not require strong volume support.

There is also a third possibility that can negate the triangle pattern.

The index may continue to move sideways through the apex of the triangle, which is approximately at the 8250 level. In such an event, the 8250 level can become a support-resistance level for future Nifty movements.

Daily technical indicators are giving mixed signals, which often happens during periods of consolidation. MACD is mildly bullish, as it has crossed above its signal line in negative zone. ROC is a little bearish. It has crossed below its 10 day MA, and looks ready to enter negative zone.

RSI is looking bullish. It has bounced up after receiving support from its 50% level. Slow stochastic is in bullish zone (i.e. above its 50% level), but its upward momentum has stalled.

On balance, the scale is tipped in favour of bulls. The gradually rising 200 day EMA - with the index trading above the long-term moving average - should dispel any doubts about the continuation of the bull market.

The consolidation can be used as an opportunity to reallocate your portfolio. If you are a patient long-term investor, let the consolidation play out. If you are interested in making quick profits – you are at the wrong place.

FIIs have been net sellers of equity worth Rs 2200 Crores this month. DII net buying of about Rs 1400 Crores has prevented a bigger fall in Nifty. Both FIIs and DIIs were net sellers today.

Global economic growth is likely to be lower than an earlier forecast of 3.4% by the World Bank. Sharply falling oil prices is an indication of lack of demand. Slower growth and a rising Dollar index have motivated many FIIs to book profits.

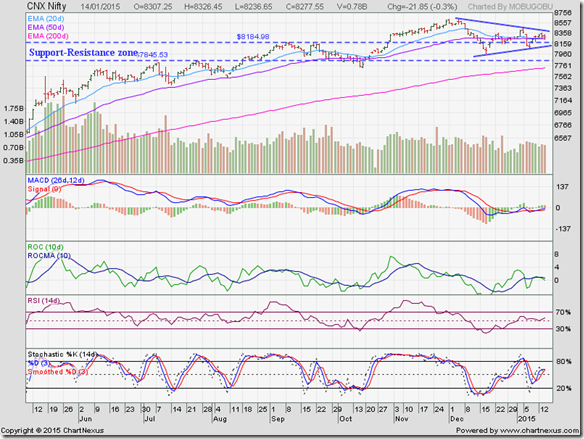

After forming a small ‘double top’ reversal pattern in early Dec ‘14 (by touching levels of 8623 on Dec 1 and 8627 on Dec 4), Nifty corrected sharply below its 20 day and 50 day EMAs but found good support in the support-resistance zone between 7840 and 8180.

The index has since been consolidating sideways within a ‘symmetrical triangle’ pattern. Since triangle patterns tend to be unreliable, the eventual break out can occur in either direction.

The index has already touched the upper (downward-sloping) resistance line and the lower (upward-sloping) support line of the triangle twice. That means a break out from the triangle can occur at any time.

Remember that for technical validity any upward break out should be accompanied by a surge in volumes. Otherwise, the break out may turn out to be ‘false’. A downward break does not require strong volume support.

There is also a third possibility that can negate the triangle pattern.

The index may continue to move sideways through the apex of the triangle, which is approximately at the 8250 level. In such an event, the 8250 level can become a support-resistance level for future Nifty movements.

Daily technical indicators are giving mixed signals, which often happens during periods of consolidation. MACD is mildly bullish, as it has crossed above its signal line in negative zone. ROC is a little bearish. It has crossed below its 10 day MA, and looks ready to enter negative zone.

RSI is looking bullish. It has bounced up after receiving support from its 50% level. Slow stochastic is in bullish zone (i.e. above its 50% level), but its upward momentum has stalled.

On balance, the scale is tipped in favour of bulls. The gradually rising 200 day EMA - with the index trading above the long-term moving average - should dispel any doubts about the continuation of the bull market.

The consolidation can be used as an opportunity to reallocate your portfolio. If you are a patient long-term investor, let the consolidation play out. If you are interested in making quick profits – you are at the wrong place.

No comments:

Post a Comment