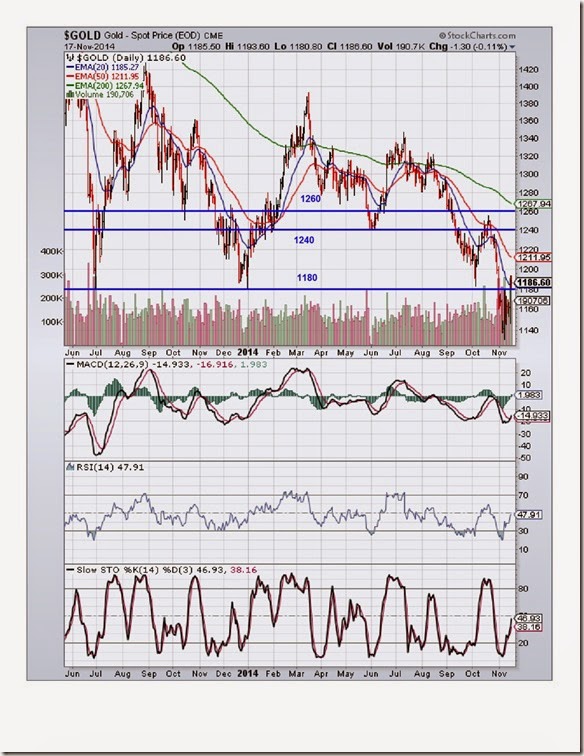

Gold Chart Pattern

In the previous post on the daily bar chart pattern of gold, the long-term support level of 1180 had been breached on high volume support. Oversold technical indicators had raised the possibility of a rally – which bears were expected to sell into.

On Nov 7 ‘14, gold’s price dropped to a new low of 1130 but formed a ‘reversal day’ pattern (lower low, higher close) backed by strong volumes that pulled back to the 1180 level. Bear selling failed to push gold’s price to a new low.

After touching a higher bottom of 1145, gold’s price crossed – and closed – above the 1180 level and its 20 day EMA on Nov 14 ‘14 on strong volume support. On the next trading day (Nov 17), gold’s price pulled back to test the 1180 level but closed above it. That is an indication that the rally from the low of 1130 may continue a little longer.

Daily technical indicators have corrected oversold conditions, and are turning bullish. But all three are still in bearish zones. The support/resistance zone between 1240-1260 may come into play once again if the rally continues.

On longer term weekly chart (not shown), gold’s price is trading below its three weekly EMAs in a long-term bear market. Technical indicators are in bearish zones. The next long-term support is at 1000; that is where gold’s price may find a bottom.

Silver Chart Pattern

The daily bar chart pattern of silver dropped to a new intra-day low of 15 on Nov 7 ‘14, but formed a ‘reversal day’ pattern (lower low, higher close) backed by strong volumes. Oversold daily technical indicators led to a rally that crossed and closed above the 16 level and the 20 day EMA.

On Nov 17 ‘14, silver’s price pulled back to the 16 level but managed to close above it. Technical indicators have corrected oversold conditions, but remain in bearish zones. MACD has emerged from its oversold zone. RSI and Slow stochastic are climbing towards their respective 50% levels.

Bears can be expected to step in at any time if the rally continues.

On longer term weekly chart (not shown), silver’s price is trading well below its three weekly EMAs in a long-term bear market. Technical indicators are trying to correct oversold conditions, but remain in bearish zones. The next long-term support is at 14.

No comments:

Post a Comment