S&P 500 Index Chart

The 6 months daily bar chart pattern of S&P 500 shook off the bears by soaring past the 1960 level, and rose to touch new intra-day (1995) and closing (1992) highs on Thu Aug 21, before correcting a bit by the end of the week. By moving above its previous top of 1991 – touched on Jul 24 – the bulls seem to have regained complete control. Or, have they?

Volumes during the week’s rally were below the 6 months average. The index has moved too sharply above its 20 day moving average. All three technical indicators are showing negative divergences by failing to touch new highs with the index. These have bearish implications in the near term.

Also, by touching a marginally higher top on lower volumes (than on Jul 24), the possibility of a double-top reversal pattern has opened up. The double-top will get confirmed only if the index falls below its Aug 7 low of 1905. That may not happen – but forewarned is forearmed.

Daily technical indicators are in bullish zones, with the exception of Slow stochastic, which has reached overbought levels. The index is TRADING above all three EMAs in a bull MARKET

above all three EMAs in a bull MARKET . The 4.3% correction from the Jul 24 top of 1991 was just a bull market correction. But it is better to be a little cautious than euphoric when the index is near a lifetime high.

. The 4.3% correction from the Jul 24 top of 1991 was just a bull market correction. But it is better to be a little cautious than euphoric when the index is near a lifetime high.

On longer term weekly chart (not shown), the index is trading above all three weekly EMAs in a long-term bull market. Weekly technical indicators are in bullish zones but showing negative divergences by failing to touch new highs with the index. Sliding volumes is another concern for bulls. Booking part profits may be a good idea.

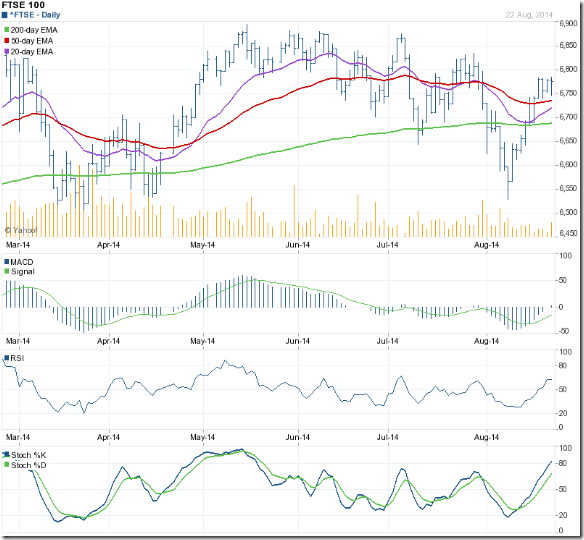

FTSE 100 Index Chart

The 6 months daily bar chart pattern of FTSE 100 closed above its three EMAs in bull territory on all 5 days of the week, but was unable to make much upward progress. By failing to cross above its previous top of 6834, the bearish pattern of ‘lower tops and lower bottoms’ continue.

Technically, the index is in a bull MARKET . Daily technical indicators are looking bullish. MACD has risen above its signal line into positive territory. RSI has climbed above its 50% level. Slow stochastic has entered its overbought zone.

. Daily technical indicators are looking bullish. MACD has risen above its signal line into positive territory. RSI has climbed above its 50% level. Slow stochastic has entered its overbought zone.

The index appears to be forming a bullish ‘flag’ pattern. A likely upward break out from the ‘flag’ may take the index to a new high.

On longer term weekly chart (not shown), the index is TRADING above all three weekly EMAs in a long-term bull market. Weekly technical indicators are turning bullish.

above all three weekly EMAs in a long-term bull market. Weekly technical indicators are turning bullish.

No comments:

Post a Comment